Large Family Money Hacks That Actually Work (10 Proven Tips)

Large family money hacks become essential when your grocery receipts look like novels. The receipt from our last grocery run was three pages long—three pages of groceries for one week with six kids.

I stared at that number at the bottom and wondered if we’d accidentally bought the entire dairy section. We hadn’t. That’s just life when you’re feeding a small army every single day.

If you’re raising multiple kids, you know exactly what I’m talking about. The grocery bills that make you question your life choices. The sports fees that arrive like clockwork. The clothes that somehow shrink or disappear faster than your patience on a Monday morning.

But here’s what I’ve learned after twenty years of marriage and six kids later: cutting costs doesn’t mean cutting joy. It means getting smarter about where your money goes.

Why Large Families Struggle with Traditional Money Advice

Most budgeting advice assumes you’re feeding two adults and maybe 2.3 children. When you’ve got six kids ranging from teenagers to toddlers, traditional money tips feel about as useful as a chocolate teapot.

✅ The real pain points hit different when you’re raising a small village:

- Food costs that rival a small restaurant’s monthly budget

- Clothing expenses that multiply faster than rabbits

- Activity fees for sports, music lessons, and school events that stack up like pancakes

- Transportation costs when your minivan drinks gas like my teenagers drink milk

Between six kids, I’ve funded entire sports leagues in cleats alone. Every season brings new equipment requirements, and somehow every child plays a different sport that requires completely different gear.

The math gets brutal fast. According to U.S. News recent data, raising one child can cost between $241,106 to $513,722 from birth to age 17, depending on your income level. When adjusted for 2025 inflation, the average jumps to $322,427 per child. Multiply that by your number of kids, and you’re looking at serious money that demands smart large family money hacks.

💡 Meal Planning Hacks That Save Hundreds Monthly

Food is where large families can make or break their budget. I’ve watched our grocery bills swing from reasonable to “Did we accidentally cater a wedding?” depending on how organized we were that week.

Batch cooking became our lifeline. Every Sunday, I spend three hours preparing meals that’ll carry us through the week. Chili, spaghetti sauce, and casseroles that can feed eight people without requiring a second mortgage.

Chili is like the duct tape of meal planning—it holds everything together and somehow works for days. One pot feeds everyone, leftovers stretch into lunch, and you can throw it over rice, pasta, or baked potatoes for completely different meals.

The freezer became our best friend. When chicken goes on sale for $0.99 per pound, we buy 20 pounds and spend an afternoon portioning it into family-sized servings. Same strategy works for ground beef, pork chops, and any protein that stores well frozen.

Menu planning prevents the expensive “What’s for dinner?” panic. When 6 PM rolls around and you haven’t planned, you’re either ordering pizza or making three trips to the store for overpriced ingredients. Both options destroy your big family budgeting efforts.

I keep a master list of 30 meals our family actually eats. Not Pinterest-perfect meals that require seventeen ingredients we’ll never use again. Real meals that kids will eat without staging a revolt at the dinner table.

🛒 Grocery Shopping Tricks That Actually Work

Shopping for eight people requires military-level strategic planning. You can’t just wander the aisles hoping inspiration strikes—you’ll leave with a cart full of impulse purchases and no actual meals.

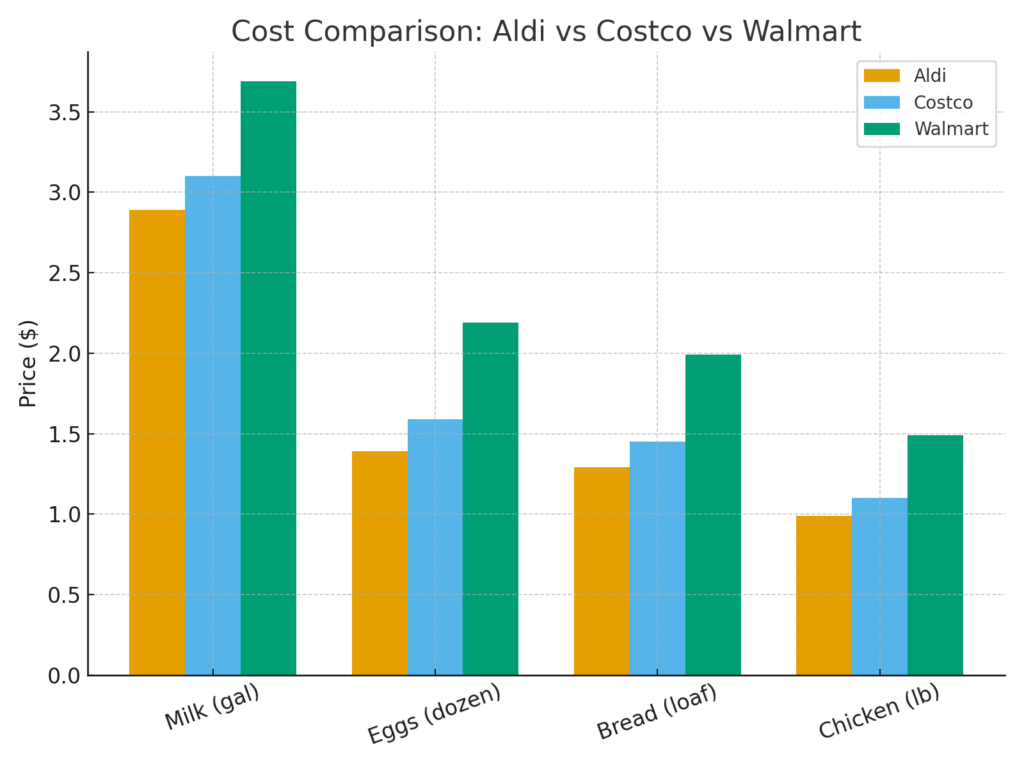

Aldi became our primary grocery headquarters. Their prices on basics like milk, eggs, bread, and produce consistently beat everyone else. The quarter cart deposit system keeps my kids from wandering off, which is honestly worth the membership fee alone.

According to USDA grocery data, families spent an average of 1.2% more on groceries in 2024 than in 2023, making smart shopping strategies essential.

Costco membership pays for itself when you’re buying milk by the gallon and peanut butter by the industrial container. We once went through three gallons of milk in two days. At this point, I’m seriously considering buying a cow.

Coupon apps like Ibotta and Rakuten add up to real savings over time. I’m not talking about extreme couponing where you need a separate storage unit for your toothpaste collection. These simple cash-back apps work while you’re already shopping.

The key with saving money with kids is buying what you actually use in quantities that make sense. Avoid buying 47 tubes of toothpaste because they’re cheap—they don’t help if they expire before you use them.

Generic brands work for most everything except the few items your kids have strong preferences about. My teenagers will revolt over generic cereal, but they can’t tell the difference between name-brand and store-brand milk.

Shopping with a detailed list prevents the “$30 trip that somehow became $180” phenomenon. Every parent knows exactly what I’m talking about.

👕 Clothing and Seasonal Swaps

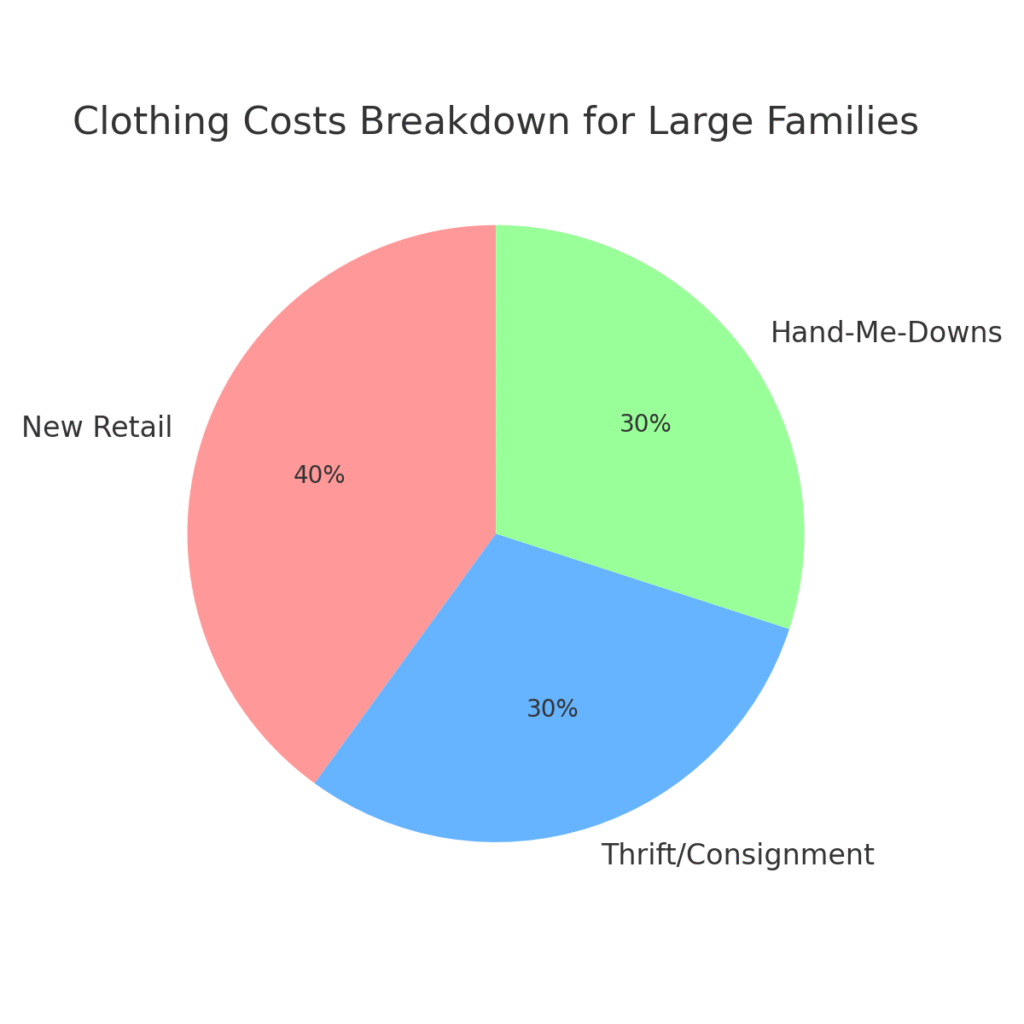

Clothing six kids feels like trying to dress a small army on a civilian budget. Between growth spurts, lost items, and the mysterious disappearance of socks, clothing costs can spiral out of control fast.

Hand-me-downs between siblings save thousands annually. The five sisters operate like a clothing exchange program. What doesn’t fit one daughter automatically gets passed down the line until someone can wear it.

The girls play a game called “Who wore it best?” Spoiler alert: nobody actually cares as long as it’s clean and fits reasonably well.

Thrift stores and consignment shops became goldmines for growing kids. You can outfit an entire child for the cost of one new shirt at regular retail prices. The trick is shopping these stores regularly instead of waiting until you desperately need something.

End-of-season clearance shopping requires planning ahead. Buying winter coats in February for next year saves 70% compared to shopping in November when everyone needs coats immediately.

I learned to buy clothes slightly larger rather than perfectly fitted. Kids grow faster than weeds, and buying room to grow extends the useful life of everything by several months.

Sock and underwear bulk buying from warehouse stores makes sense for large families. These basics wear out constantly, and having backup inventory prevents emergency shopping trips at full retail prices.

🏠 Housing and Utilities on a Large Family Budget

Housing costs hit different when you need space for eight people instead of three or four. Whether you’re renting or owning, maximizing space efficiency directly impacts your family cost-cutting tips success.

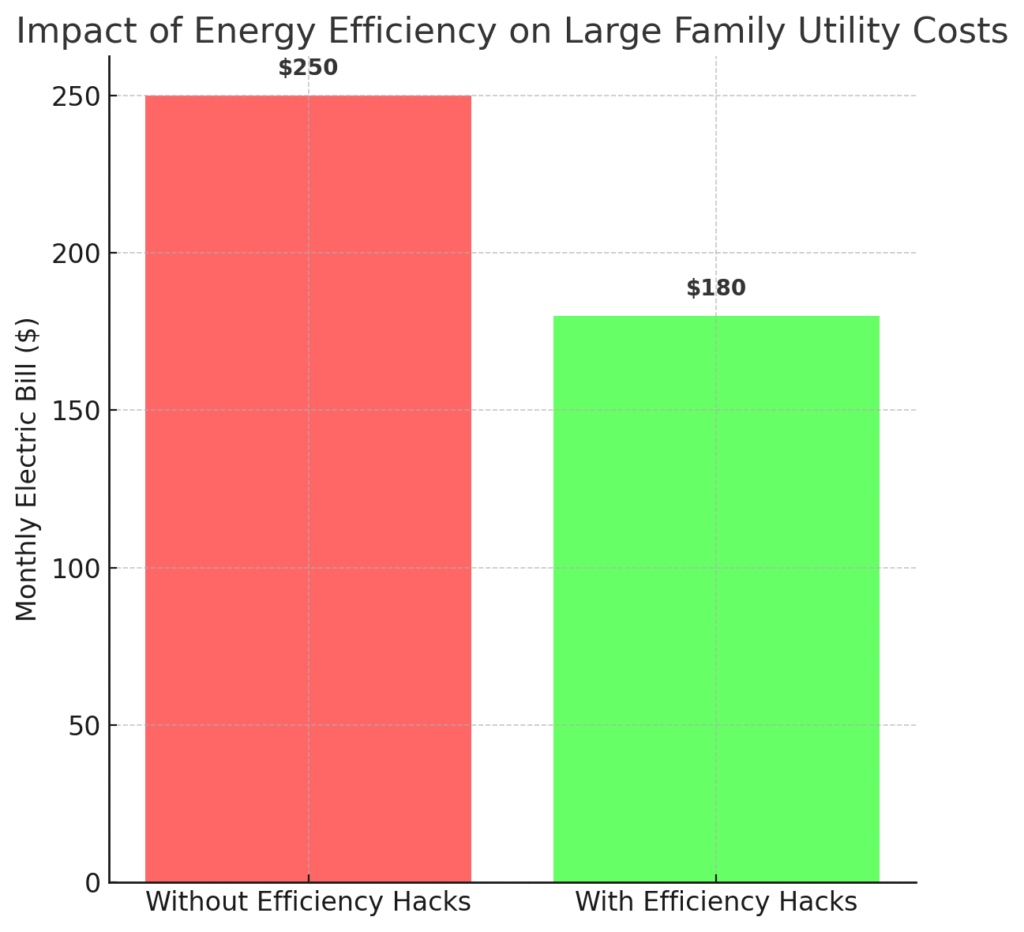

Energy efficiency becomes critical with larger families. More people means more showers, more lights left on, and more devices charging constantly. Our electric bill can swing $50-100 monthly depending on how conscious everyone is about energy usage.

If a light gets left on somewhere in our house, it’s not a mistake. It’s a personal attack on my electric bill.

Simple weatherproofing saves real money. Draft stoppers, programmable thermostats, and basic insulation improvements pay for themselves within months when you’re heating and cooling space for eight people.

Water conservation matters more with larger families. Low-flow showerheads, shorter shower timers, and teaching kids to turn off water while brushing teeth adds up to meaningful savings monthly.

DIY maintenance and repairs become essential skills. When you’ve got six kids, something breaks every week. Learning basic plumbing, electrical work, and appliance troubleshooting prevents expensive service calls.

The home maintenance projects that matter most are the ones that prevent bigger expensive problems later. Regular HVAC filter changes, gutter cleaning, and basic preventative care save thousands in emergency repairs.

🎯 Family Activities That Don’t Require a Trust Fund

Entertainment costs can destroy budgets faster than kids destroy new shoes. But keeping six kids engaged and happy doesn’t require spending like you’re funding a small theme park. Smart large family money hacks focus on free and low-cost options.

Local parks became our entertainment headquarters. Free playgrounds, hiking trails, and sports facilities provide hours of entertainment without any admission fees. Pack snacks and drinks, and you’ve got an entire day’s entertainment for the cost of gas.

Family game nights cost $20 upfront for a game that provides months of entertainment. Board games, card games, and puzzles keep everyone engaged without requiring electronic devices or subscription services.

Community center programs offer structured activities at fraction of private costs. Swimming lessons, sports leagues, and summer camps through community centers typically cost 50-70% less than private alternatives.

Nothing says family bonding like untangling six fishing lines simultaneously. But seriously, fishing provides hours of entertainment for the cost of bait and snacks. State parks often have fishing areas that don’t require special licenses for kids.

Library programs deserve more credit. Story times, craft sessions, and summer reading programs provide free structured activities plus access to books, movies, and educational resources.

The key is planning activities around free or low-cost options instead of defaulting to expensive entertainment when boredom strikes.

🚗 Transportation and Travel Strategies

Moving eight people anywhere requires logistics planning that rivals military operations. Transportation costs—gas, maintenance, insurance—scale up dramatically with larger families.

Minivan math becomes essential. Understanding your vehicle’s fuel efficiency and planning trips to combine multiple errands saves both time and gas money. Every trip needs to accomplish three things instead of one.

The first rule of family road trips: somebody will need to pee exactly five minutes after you just stopped for someone else to pee. Plan accordingly and budget extra time for everything.

Group activities and carpooling arrangements with other families reduces individual transportation costs. Instead of six separate trips to soccer practice, coordinate with other parents to share driving responsibilities.

Maintenance becomes more critical with higher mileage vehicles carrying larger loads. Regular oil changes, tire rotations, and basic upkeep prevent expensive breakdowns and extend vehicle life.

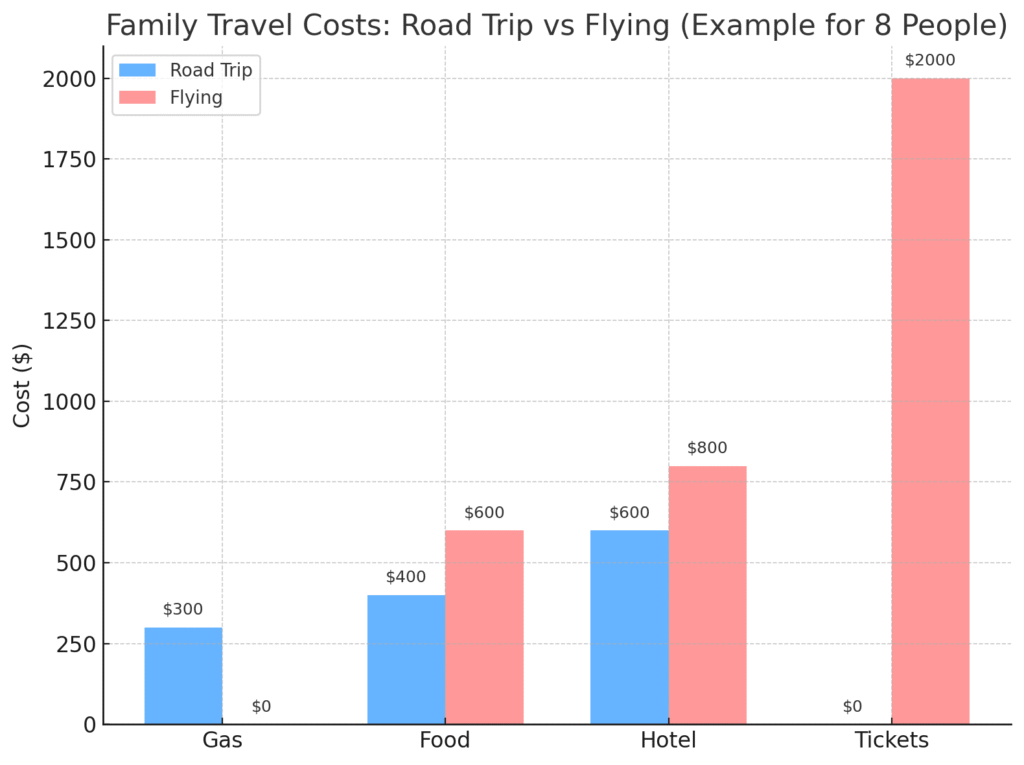

Road trip planning requires more careful budgeting but often costs less than flying eight people anywhere. Hotels with kitchenettes allow meal preparation, significantly reducing food costs during travel.

📊 Budgeting Systems That Work for Chaotic Families

Traditional budgeting advice assumes you have predictable expenses and organized systems. When you’re managing the financial needs of eight people, you need frugal living for families approaches that can handle chaos.

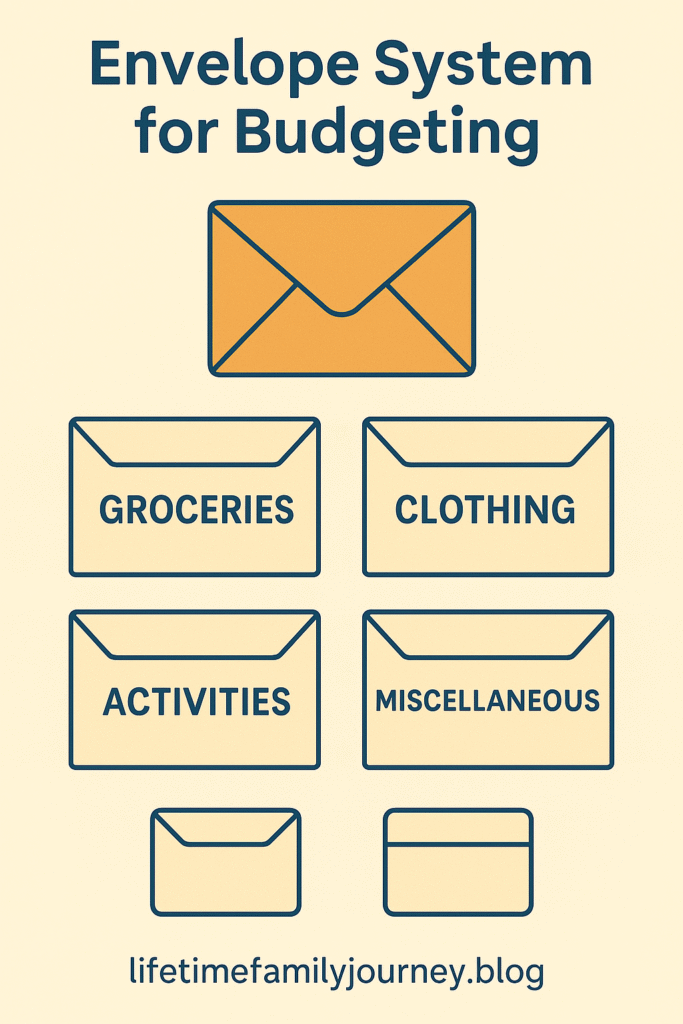

The envelope system works well for large families because it’s visual and simple. Cash envelopes for groceries, clothing, activities, and miscellaneous expenses prevent overspending in any category.

Our budget spreadsheet became the closest thing to a video game that I play. Only instead of fighting monsters, I’m battling unexpected expenses that pop up like boss battles.

Zero-based budgeting forces you to assign every dollar a job before the month starts. With six kids generating constant expenses, knowing exactly where money needs to go prevents the “Where did all our money go?” conversations.

Apps like YNAB (You Need A Budget) or EveryDollar help track spending across multiple categories without requiring advanced spreadsheet skills. The key is finding a system simple enough to maintain consistently.

Regular budget meetings with your spouse become essential. When expenses change weekly based on kids’ activities, school events, and unexpected needs, staying coordinated prevents financial surprises.

The family routine that includes weekly money check-ins keeps everyone aware of spending and upcoming expenses.

💰 Teaching Kids Money Management Early

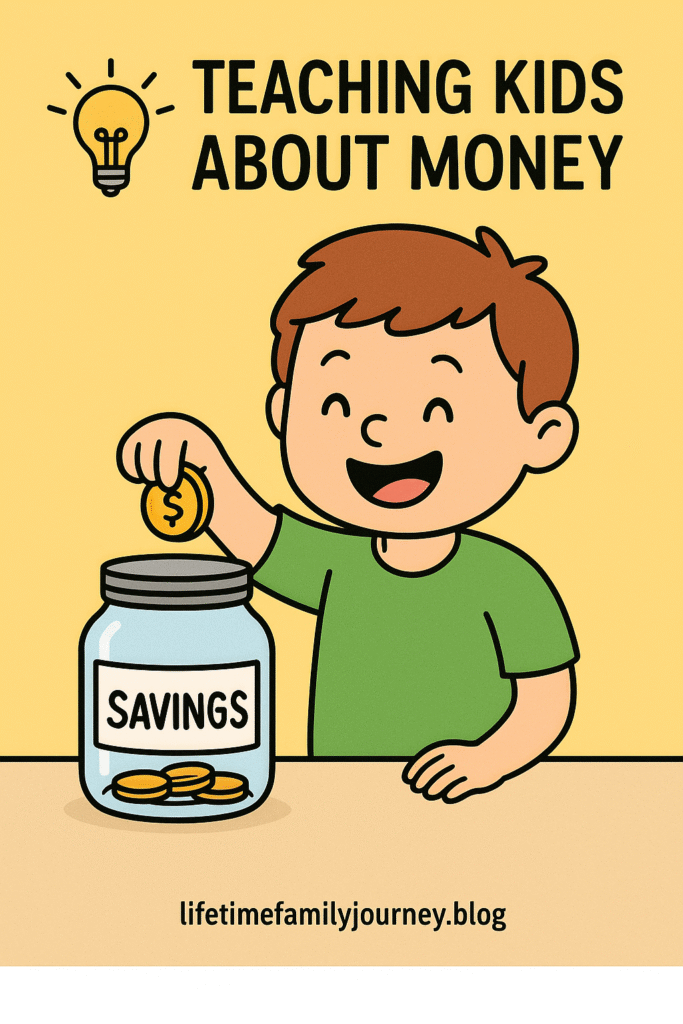

Getting kids involved in family financial decisions teaches valuable life skills while reducing your burden as the sole financial manager. Even young children can understand basic money concepts when explained appropriately.

Age-appropriate allowances tied to specific responsibilities create accountability. Kids learn that money comes from work, not magic ATM machines that dispense cash on demand.

My son Brayden once tried to charge rent for using his LEGO collection. Future landlord energy right there, but it showed he understood value exchange concepts.

Teaching kids to comparison shop during grocery runs helps them understand why we choose certain brands or stores. They start recognizing that cheaper doesn’t always mean lower quality, but expensive doesn’t automatically mean better.

Savings jars or accounts for kids’ goals make abstract concepts concrete. When they’re saving for a specific toy or activity, they understand why we skip impulse purchases that interfere with bigger goals.

Including older kids in family budget discussions helps them understand why certain expenses take priority over others. They learn that household necessities come before entertainment expenses.

The back-to-school shopping process becomes a teaching opportunity about needs versus wants, comparison shopping, and planning ahead for predictable expenses.

🎯 DIY Projects That Actually Save Money

DIY culture gets a bad reputation because social media makes everything look either Pinterest-perfect or completely disastrous. But practical DIY projects for large families focus on function over form and genuine cost savings.

Basic home repairs become essential skills when you’ve got eight people wearing out everything faster. Learning to fix leaky faucets, patch holes in walls, and troubleshoot appliance problems saves hundreds annually in service calls.

Simple organization projects prevent expensive replacement purchases. Building basic shelving, creating toy storage solutions, and organizing closets helps you find things instead of buying duplicates because you can’t locate what you already own.

Food preservation through canning, freezing, and dehydrating extends the life of bulk purchases. When you buy 20 pounds of apples on sale, knowing how to preserve them prevents waste and provides snacks for months.

The key is choosing DIY projects based on actual needs rather than trending Pinterest ideas. Focus on solutions that solve real problems your family faces instead of creating magazine-worthy spaces that require constant maintenance.

Family activities can include DIY projects that engage kids while accomplishing useful goals. Building a simple garden, creating outdoor games, or organizing common areas teaches skills while improving your living situation.

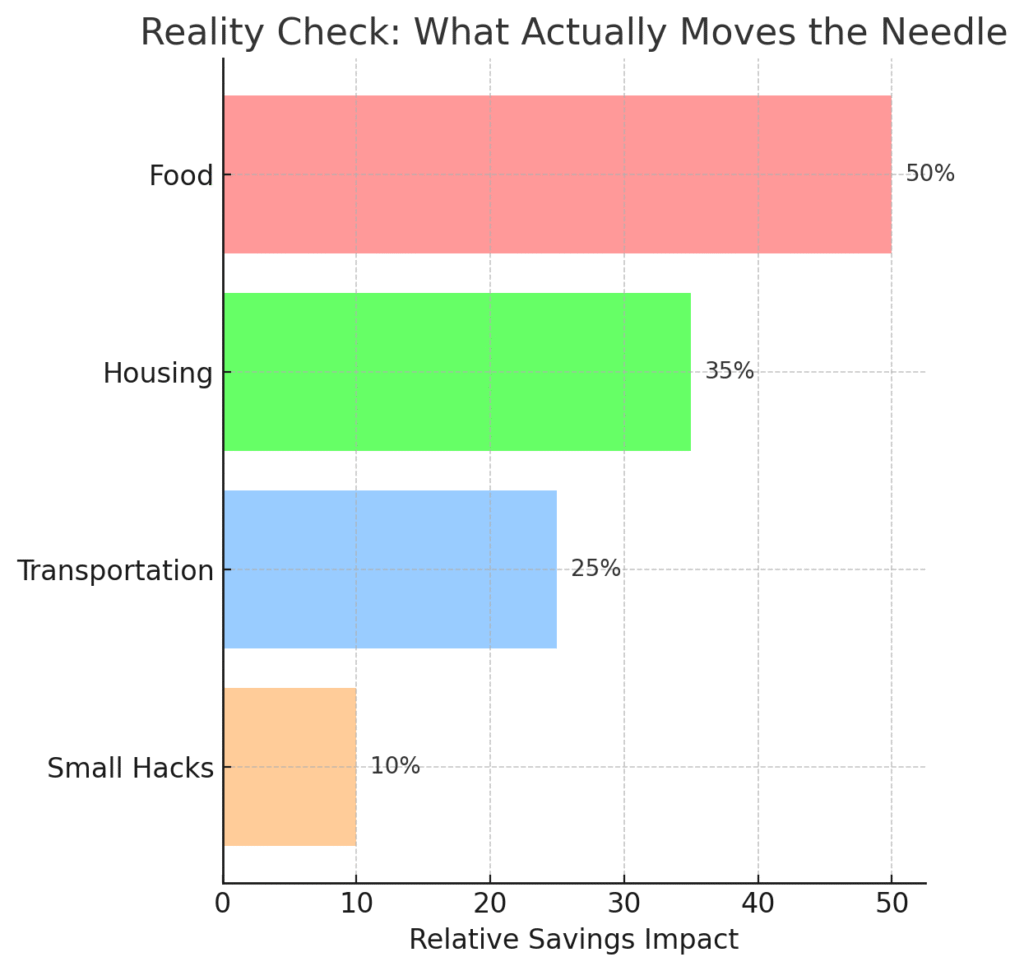

🏆 The Reality Check: What Actually Moves the Needle

After years of testing different strategies, some make dramatic differences while others provide minimal impact. Focus your energy on changes that create substantial savings rather than tiny optimizations that require enormous effort.

According to Ramsey Solutions research, food overspending is one of the biggest budget busters, but also one of the biggest opportunities for saving money. The average household spends around $504 monthly on groceries, but families with six kids like ours can easily spend double or triple that amount.

Housing decisions—whether renting versus buying, location choices, or space utilization—affect monthly expenses more than any number of coupon apps or small cost-cutting measures.

Transportation efficiency through trip planning, vehicle maintenance, and carpooling arrangements saves both money and time. Time savings matter enormously when you’re coordinating schedules for eight people.

Teaching kids financial responsibility reduces long-term costs while building life skills. Kids who understand money concepts early require less financial support as teenagers and young adults.

The strategies that stick are simple enough to maintain during busy seasons, stressful periods, and normal family chaos. Complex systems that require perfect execution fail when life gets hectic.

The most effective strategies work best when they become automatic habits rather than constant decisions requiring willpower and perfect planning. These sustainable large family money hacks survive busy seasons, stressful periods, and normal family chaos.

Final Thoughts: Cutting Costs Without Cutting Joy 💡

Running a large family on a reasonable budget isn’t about deprivation or making everyone miserable to save money. It’s about being intentional with spending so you can afford the things that actually matter to your family.

The best family cost-cutting tips are the ones that improve your life while saving money. Better meal planning means less daily stress AND lower grocery bills. Organized systems mean less chaos AND fewer replacement purchases for lost items.

Focus on the big wins first. Saving 10% on groceries matters more than finding the cheapest laundry detergent. Housing and transportation efficiency create larger budget impacts than most smaller optimizations.

Remember that frugal living for families looks different than single-person or small-family budgeting. Your strategies need to handle chaos, accommodate growth, and maintain sanity for everyone involved while delivering real savings.

What money-saving strategies work best for your family? Share your favorite large family money hacks in the comments—we’re always looking for new ideas that actually work in real life, especially when managing the chaos of multiple kids and tight budgets.

Explore More from Our Family of Blogs

Mountains Will Move

Faith-based encouragement for everyday families.

Everyday Exposed

No-filter truth hub for critical thinking and clarity.

Thank you for being part of the community. God Bless you and your family.